I want you to Imagine the following:

Every great business starts with a simple idea and usually

to solve a problem. Uber was started in 2009 because its

founders were having trouble getting a taxi in Paris I do

believe.

Now it’s in 70 countries and over 10,500 cities.

Imagine back in 2010 if you had been referring other

agents, drivers and riders and a number of them had been

doing the same. And you were getting paid on every every time

the driver picked up a rider and every time the rider took a ride.

It’s not inconceivable you would be worth

over $100 million dollars today.

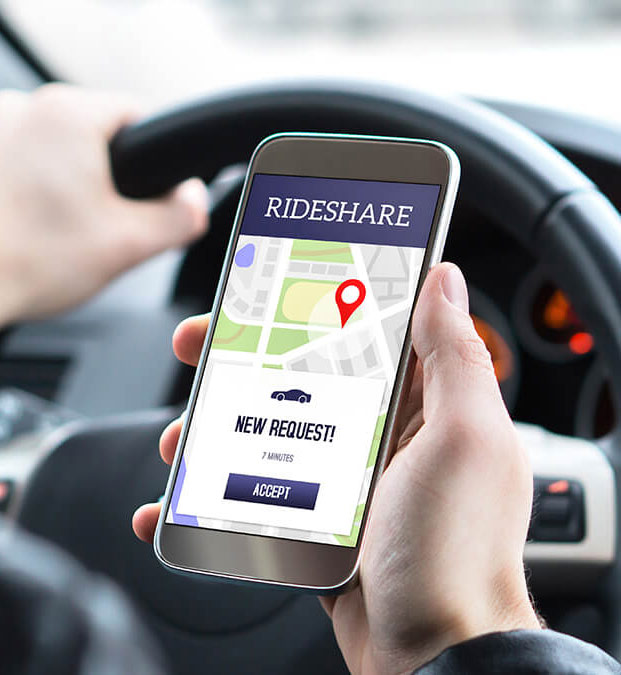

Just like Uber was started to solve a problem. Now there is a

new Ride Share company Revo RideShare. Their goal is to

displace Uber and Lyft as the biggest Ride Share companies.

The big problem Revo is looking to solve is that the Drivers

for these other companies to say the least are quite dissatisfied

with the companies they drive for. For example in many cases the

drivers were only getting around 40% of the fare charged to the

rider. These drivers are just itching to leave these other companies

for something better.

With Revo the drivers will make much more, while the riders pay

less than the big guys..

Plus with the ability for the Revo agents, drivers, and riders to refer and

earn from these referrals and you are right now here smack right at the very

beginning You have a real chance to chart the future for you and your

family.

You can become involved now by clicking on the link below and

registering.

https://revoride.com/register.php?ref=10988530

Revo RideShare above is on a mission to disrupt the whole RideShare industry,

I invite you to come and be part of it.